China’s Race to Close AI Chip Gap with US Tech Giant Nvidia

China is making significant strides in developing advanced artificial intelligence microchips, though experts predict it could take until 2030 or beyond to match the technological sophistication of US industry leader Nvidia.

The push comes as Beijing seeks to circumvent Washington’s export restrictions on cutting-edge chips used in AI systems, which the United States has implemented citing national security concerns and potential military applications.

“China wants chips that policy cannot take away,” explained Stephen Wu, founder of Carthage Capital investment fund and former AI software engineer. However, Wu cautions that achieving “full end-to-end parity with Nvidia’s best chips, memory packaging, networking and software” remains uncertain even beyond 2030.

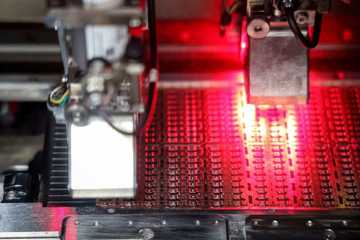

The Chinese semiconductor sector has seen surging investor interest, with chip-related stocks rising on announcements of computing advances and planned production increases. Yet significant technical hurdles remain, particularly in high-bandwidth memory and packaging technology, which Wu describes as “the hardest and most complex parts of the chip.” Manufacturing tools and software development also present major challenges.

Industry analysts, including George Chen of The Asia Group, broadly agree that China needs five to ten years to catch up. Despite substantial government support, the required investment is “immense,” according to research strategist Dilin Wu of Pepperstone.

Major Chinese tech companies are making bold moves in the sector. Alibaba is investing billions in AI technology, while Huawei reportedly plans to double production of its flagship Ascend 910C chip. Smaller player Cambricon, dubbed “China’s Nvidia,” has seen its stock value surge. Even Xiaomi is returning to chip design despite previous setbacks, with CEO Lei Jun declaring that “chips are the only way for Xiaomi to succeed.”

China remains the world’s largest semiconductor market, with Nvidia maintaining a strong presence despite restrictions. iFLYTEK’s AI translation software general manager Chen Cheng acknowledges that Nvidia chips remain superior for training large language models, though her company has adapted by switching to Huawei chips, currently considered China’s best.

The situation has created pressure on Nvidia from both sides. Recent reports indicate Beijing has restricted major Chinese firms from purchasing a specialized Nvidia processor designed for the Chinese market. Additionally, Nvidia must now pay 15% of certain AI chip sales revenue in China to the US government.

Nvidia CEO Jensen Huang, known for his signature leather jacket, has suggested that export restrictions might accelerate China’s technological advancement, noting that Chinese competitors are “nanoseconds behind us” and emphasizing the need to maintain competitiveness.

Leave a Comment