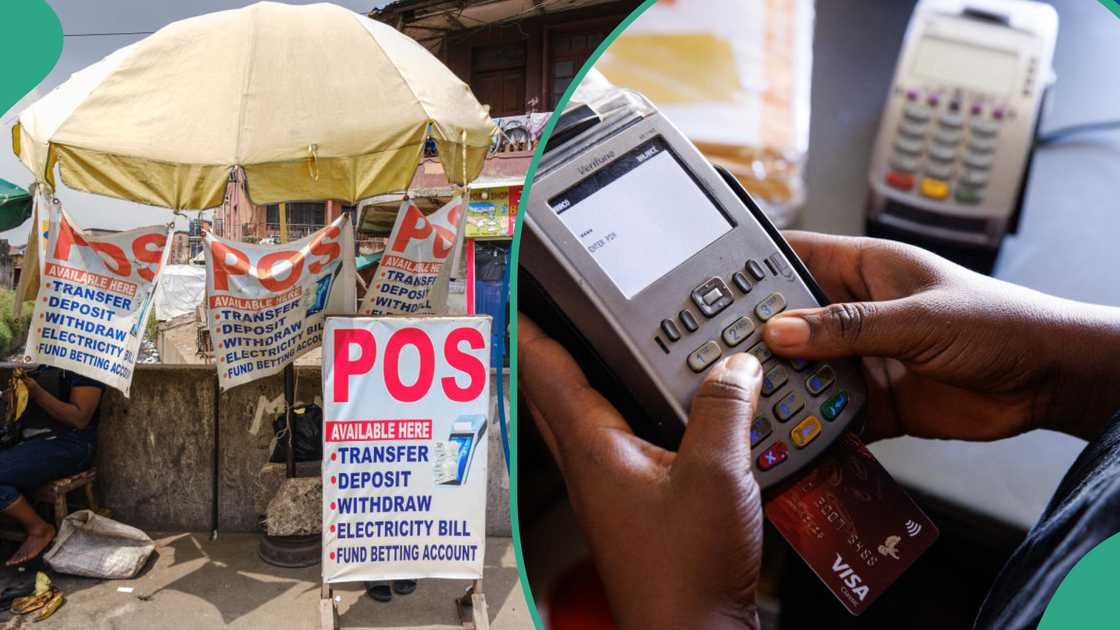

CBN Implements New Transaction Limits for POS Operators in Major Banking Reform

The Central Bank of Nigeria (CBN) has introduced comprehensive new guidelines for Point of Sale (POS) operations, setting daily transaction limits and strengthening regulatory oversight of agent banking services across the country.

Under the new framework announced on Monday, October 6, 2025, POS agents will be restricted to cumulative daily cash transactions of N1.2 million, while individual customers face a N100,000 daily limit. The directive, detailed in document PSP/DIR/CON/CWO/001/049, takes immediate effect.

Key Changes in Transaction Limits:

– Individual customers: N100,000 daily and N500,000 weekly limits for deposits and withdrawals

– Daily bill payments capped at N100,000

– Weekly bill payment limit set at N100,000

The revised guidelines, signed by Musa Jimoh, director of the payments system management department, introduce several technological and operational requirements. All POS devices must be geo-fenced to operate only within registered locations, with this provision taking full effect from April 1, 2026.

“The guidelines aim to establish minimum standards for operating agent banking in Nigeria, enhance service quality, and encourage responsible market conduct,” the CBN circular stated.

Additional Regulatory Requirements:

– Mandatory use of dedicated accounts for agent banking transactions

– Monthly reporting of transaction data, fraud cases, and customer complaints

– Publication of agent lists on financial institutions’ websites

– Super agents must maintain at least 50 sub-agents across Nigeria’s six geopolitical zones

– Five-year retention of transaction audit trails

The new framework comes as POS transactions in Nigeria reached record levels, with transactions valued at N18 trillion in 2024 and 1.5 billion transactions processed, marking an 8% increase from the previous year.

For regulatory compliance, financial institutions must submit monthly reports by the 10th day of the following month, covering transaction volumes, fraud incidents, and agent activities. The CBN maintains the authority to adjust transaction limits as needed, aligning with existing banking guidelines.

This comprehensive reform aims to strengthen financial stability, enhance consumer protection, and promote broader financial inclusion across Nigeria’s banking sector.

Leave a Comment