PalmPay Achieves Historic First Transaction on Nigeria’s New National Payment Stack

In a groundbreaking development for Nigeria’s financial sector, PalmPay, in partnership with Wema Bank, has successfully executed the first live transaction on the newly launched Nigeria Inter-bank Settlement System (NIBSS) National Payment Stack (NPS).

This pioneering transaction heralds a new chapter in Nigeria’s digital payment infrastructure, showcasing the next-generation system designed to transform monetary transactions across the nation. The achievement further solidifies PalmPay’s position as an innovative leader in Nigeria’s financial technology landscape.

PalmPay’s accomplishment comes amid recent international recognition, including its listing among Financial Times Africa’s Fastest-Growing Companies 2025 and consecutive appearances in CNBC and Statista’s Top 300 Global Fintech Companies in 2024 and 2025.

The NPS, built upon NIBSS’s existing infrastructure, introduces enhanced features including improved transaction speed, seamless interoperability, and real-time settlement capabilities. The system incorporates advanced security measures such as digital signatures and multi-factor authentication, setting new standards for financial security.

Nigeria’s adoption of the ISO 20022 global messaging standards through the NPS positions the country as a key player in Africa’s financial sector, particularly in facilitating cross-border transactions.

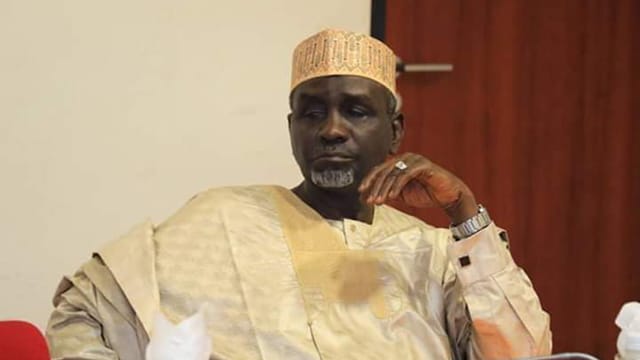

NIBSS Managing Director/CEO Premier Oiwoh praised the milestone, stating: “We commend PalmPay for this historic achievement as one of the key collaborators in executing the first successful transaction on the NPS. This milestone reflects our shared commitment to advancing a faster, safer and more interoperable payment ecosystem for Nigeria.”

PalmPay’s Group Chief Commercial Officer, Jaipei Yan, emphasized the significance for the nation: “This achievement is a win for Nigeria and Nigerians. PalmPay is all about providing smarter banking solutions. Since our launch six years ago, we have focused on bridging the gap between innovation and everyday financial inclusion.”

The successful implementation aligns with the Central Bank of Nigeria’s vision for a digitally transformed economy. PalmPay’s achievement demonstrates how technological innovation can drive economic progress while promoting financial inclusion.

Moving forward, PalmPay remains committed to its mission of creating a more connected and financially inclusive Africa, leveraging global standards while maintaining local relevance in its technological solutions.

Leave a Comment