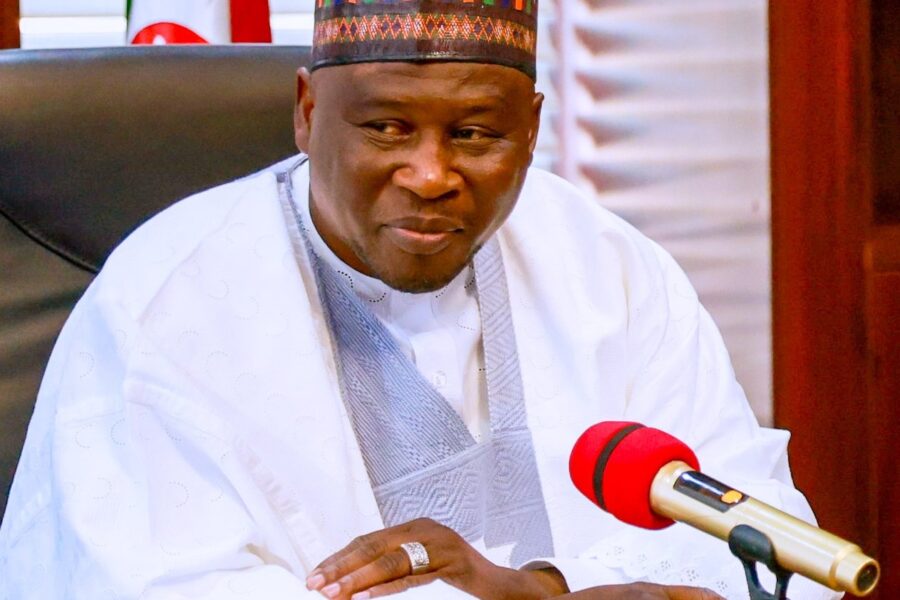

Tax Reforms Key to Nigeria’s Economic Resilience, Says FIRS Chairman

FIRS Executive Chairman Zacch Adedeji highlighted President Bola Tinubu’s tax reform agenda as a cornerstone of Nigeria’s economic strengthening strategy during a landmark address at the University of Ilesa.

Speaking at the university’s inaugural Distinguished Lecture Series on Friday, Adedeji presented his vision for transforming current revenue challenges into opportunities for strategic reform. The lecture, hosted by Vice Chancellor Taiwo Asaolu, brought together academics, policymakers, students, and industry leaders.

In his presentation titled “Economic Resilience in an Era of Dwindling Revenue,” Adedeji addressed multiple global challenges affecting public finances, including digital disruption, mounting debt, climate-related issues, and concurrent economic shocks. He outlined a comprehensive framework built on four key pillars: fiscal flexibility, policy coherence, institutional strength, and human capital adaptability.

The FIRS chairman emphasized that Nigeria’s financial future depends on strengthening institutions, diversifying revenue sources, and modernizing the tax framework. He detailed ongoing reforms under President Tinubu’s administration, which include: – Automation of tax processes – Expansion of TaxPro Max system – Enhanced taxpayer identification methods – Strategic partnerships with state governments to reduce system fragmentation

These initiatives aim to boost efficiency, transparency, and overall tax compliance across the nation.

Adedeji called for greater involvement from academic institutions in shaping national economic strategy, suggesting universities serve as innovation hubs for developing evidence-based approaches to digital taxation, revenue mobilization, and economic diversification.

The FIRS chief’s vision positions higher education institutions as vital contributors to policy development and national competitiveness, emphasizing their role in building a more resilient Nigerian economy through non-oil revenue growth, comprehensive tax reforms, and strategic skills development aligned with global economic trends.

Leave a Comment